Opening Day Countdown Thread

Collapse

X

-

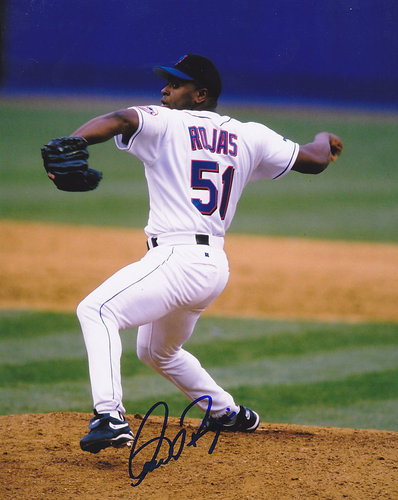

The Mets got Rojas, Brian McRrae (who had the best year of his career as a 30-year-old, 21 HR, 79 RBI, .822 OPS, .462 SLG) and Turk Wendell (awesome) from Chicago for Lance Johnson, Mark Clark and Manny Alexander. A good trade.

Of course, Rojas was later traded for BOBBY BONILLA.

Smart man that Bonilla.It was an unhappy reunion. Bonilla couldn't get regular at-bats or do much with the ones he got, hitting just .160 and spending months on the DL. In the final game of the NLCS, having already appeared as a pinch-hitter, he and Rickey Henderson played cards in the clubhouse while their teammates lost in extra innings -- an unfortunate incident that helped trigger Bonilla's last, now infamous deal.

Bonilla, active in the MLB Players Association, was concerned that a work stoppage was looming in 2001 and knew the Mets wanted to dump the final year of his contract, worth $5.9 million, to free up a roster spot. So with the futures of a daughter and son to consider too, he realized this was his chance to set aside a chunk of money. "I decided I wanted to live the rest of my life as if I were an active player," he says.

Gilbert and Bonilla did their homework and went to the team with different buyout options, and the sides agreed on a 25-year, $29.8 million deferred payment plan. Gilbert was so shocked at his success, he immediately tried to get the same deal for other clients, most of whom (Jose Canseco among them) lacked Bonilla's long view and passed. "People kept asking me, 'Why didn't the Mets just release him?'" says agent Dan Horwits, who negotiated the particulars of the deal. "I'm not sure I even knew at the time."

Only years later would it become clear why Wilpon went for the deferral: The $5.9 million went into a Madoff account, which was theoretically supposed to collect a double-digit interest rate over the life of the agreement. Only about an 8 percent return would have been needed to pay Bonilla his $1.2 million a year from 2011 to 2035. The Mets did the math and figured they'd be able to turn a $60-70 million profit on the arrangement.

Of course, we know what happened next. Not quite three years before the payments were to start, Madoff's Ponzi scheme blew sky-high. Wilpon's investments were gone, as was much of his income. Seduced by the prospect of turning a $5.9 million debt into 10 times as much free money, the Mets didn't have a dime set aside for the $29,831,205 they'd guaranteed Bonilla. In fact, without an emergency loan procured from MLB, they might not have been able to make the first payment.

http://espn.go.com/mlb/story/_/id/78...-espn-magazine

Comment

-

-

as long as you still hate Broxton

as long as you still hate Broxton

Comment